There is a link between risk and profit when it comes to investing. The greater the possible gain, the greater the danger.

But the bond is reciprocal. The more risk you accept while investing, the more your portfolio is exposed to volatility and the possibility of loss.

When it comes to investing, you must strike a balance between your desire for a high return and your willingness to deal with risk and the possibility of losing money in the market.

One of the most crucial factors to consider when developing an investment portfolio or a complete financial strategy is risk tolerance.

Risk tolerance refers to an investor’s capacity to deal with unpredictability in portfolio returns, and it manifests itself in practice as the ability and willingness to accept investing risks.

You may measure your risk tolerance by assessing your degree of comfort with various investments. Learn what risk tolerance is and how it works before you begin investing.

What Exactly Is Risk Tolerance?

In the world of investing, risk tolerance refers to how much risk you’re willing to accept with your investment strategy and how at ease you are with the possibility of losing the value of your investment.

Some investments are more volatile than others, and not all investment products are created equal.

Knowing your risk tolerance, particularly in bonds, can help you survive potentially huge changes in investment value without taking a direct lender bad credit loans guaranteed approval which you will be forced to take advantage of if you put all your money into investments.

An investor runs the danger of losing money and selling stocks at the wrong time if they take on more risk than they can manage.

The most significant factor in evaluating risk tolerance is age, which may be assessed by considering one’s investment horizon.

What are the Risk Tolerance Influencing Factors?

We’ll go through some of the elements you should think about, but bear in mind that almost all of them are interrelated in some manner.

Personal Level of Comfort

Your risk tolerance is undoubtedly influenced by your level of comfort. At the end of the day, you could have a lengthy schedule, a strong portfolio, and 30-year-out retirement goals.

However, if you shudder every time the market falls, you may not want to invest in the same manner that a very risk-tolerant investor would. Trust your own sense of comfort and allow it to lead you.

Age

The average risk tolerance of younger investors is greater than that of older ones. Younger investors have more working years to earn, save, and invest money, while pre-retirees and retirees may rely on their portfolios for day-to-day needs.

As a consequence, younger investors can endure significantly larger negative portfolio movements.

Downward market shocks may be devastating for older investors, making financial preparation crucial if you rely on stocks for a livelihood.

Financial Situation

The financial situation of an investor is one of the most important risk tolerance criteria. An investor with a large proportion of assets and a small proportion of liabilities is likely to be willing to take on more risk. It’s because they have the financial resources to either ride out short-term volatility or incur losses.

A person with a large number of liabilities relative to assets, on the other hand, may have poor risk tolerance. A person in a fragile financial situation does not have enough room to absorb losses or ride off volatility.

Goals

Different people have various financial goals. Financial planning often has other goals in addition to maximizing savings.

A strategy for investing to achieve such returns is often followed after the amount required to achieve certain goals has been established.

As a consequence, each individual will have a different level of risk tolerance based on their goals.

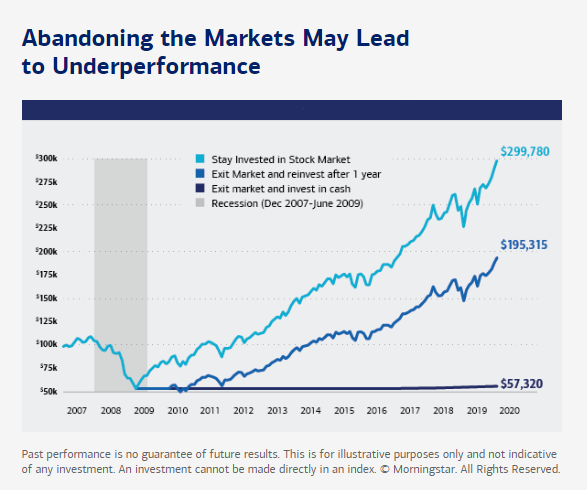

Also, courage and perseverance play an important role. An investor who withdrew from the stock market during the Great Recession of 2008–2009 and re-invested only one year later would have missed the first market bounce, drastically decreasing their prospective profits over the next ten years, as shown in the graph below.

Additionally, someone who left the stock market and converted their assets into cash ran the danger of not seeing any gains in the years that followed.

Timeline

The length of time an investor will not need their investment’s return is a crucial factor in assessing their risk tolerance. That time horizon is critical to both risk tolerance and investing goals.

A long-term investor often has a high-risk tolerance. This is because market volatility carries weight in the short term but has little influence on returns in the long run.

Investors with limited time horizons have a poor risk tolerance for the same reason. In the near term, they would be exposed to a high amount of risk if they chose high-return products, such as shares.

What is my level of risk tolerance?

It has to do with how comfortable you are taking risks and how long you can endure economic ups and downs.

When choosing your investment strategy, bear in mind that if you select a strategy that is too cautious, you may miss out on some large profits, but if you choose one that is too aggressive, you may lose the money you’ve invested.

Your risk tolerance will differ depending on your aim and stage of life. When it comes to long-term objectives like retirement, be proactive and chat with your portfolio adviser about shifting your money to less-risky assets as you near the end of your time horizon.

Remember that your risk tolerance is changing. It may vary depending on your salary, discretionary money, and age.

If you’re just starting in your profession and don’t have a lot of disposable income, you could be more conservative with your investments. You may grow more aggressive as you gain more money.

However, as you become older and see retirement approaching, you may become more cautious.

Conclusion

Your risk tolerance is not a one-time exam. As you get closer to your goal, it’s crucial to examine your investing plan to see whether you’ll have the money when you need them.

Otherwise, your risk exposure may undermine your ability to achieve your objective. Furthermore, when it comes to danger, everyone has a varying degree of comfort.

What works for one individual may not be the best method for the next, therefore it’s critical to evaluate all relevant elements.

GIPHY App Key not set. Please check settings